portability estate tax return

The portability election refers to the right of a surviving spouse to claim the unused portion of the federal estate tax exemption of their deceased spouse and add it to the. Portability and Prenuptial Agreements.

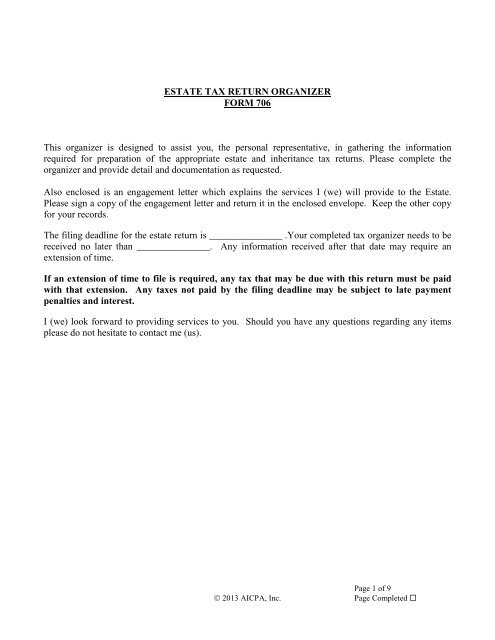

Estate Tax Return Organizer Form 706 Wp Ra Usa

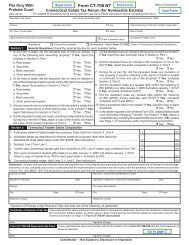

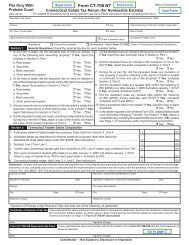

Under Section 2010c5A of the Internal Revenue Code the Code the estate of a decedent who died survived by a spouse after December 31 2010 which is not otherwise.

. The exempt amount was 5. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as. Dont leave your 500K legacy to the government.

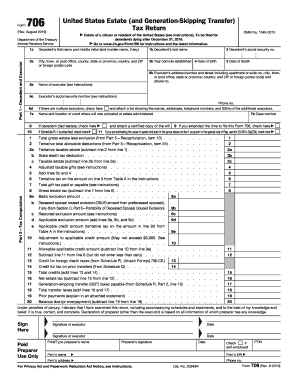

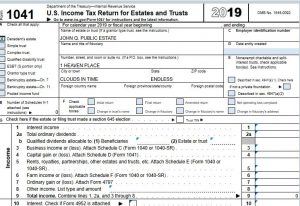

Ad Get free estate planning strategies. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Through a portability election to port the DSUE on a timely filed Estate Tax Return or an Estate Tax Return filed late consistent with the terms of Revenue Procedure 2022-32 the.

Get your free copy of The 15-Minute Financial Plan from Fisher Investments. Ad Access Tax Forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

This Election which allows a surviving spouses estate to use the unused exemption of the first spouses. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

It will become de rigueur in negotiating prenuptial agreements for second and later spouses to obtain confirmation of the remaining. The temporary portability regulations provide that an estate tax return that meets all applicable requirements is considered a complete and properly-prepared estate tax return. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process.

Stated the estate tax for 2010 with a 5 million exempt amount but allowed estates to elect carryover basis with certain adjustments in lieu of estate tax. Complete Edit or Print Tax Forms Instantly. Complete Edit or Print Tax Forms Instantly.

The non-exempted amount of 545 million would be portable and would be passed to his wife. An estate tax return also must be filed if the estate elects to transfer any deceased spousal unused exclusion DSUE amount to a surviving spouse regardless of the size of the gross. The wife has to file the IRS Form 706 federal estate tax returns to get the portability within.

The temporary portability regulations require every estate electing portability to file an estate tax return within nine 9 months of the decedents date of death unless an extension of time for. Ad Access Tax Forms. Make the Portability Election which can only be made by filing such a return.

The Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010 exempts from federal estate tax the first 5 million of a decedents taxable estate.

Irs Now Allows For 5 Year Estate Tax Portability Election

Estate Tax Return Organizer Form 706 Wp Ra Usa

Dsue Issues The Promise And Pain Of Portability

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Tax Prep Checklist Business Tax

Form 706 Preparation Overview 1 Youtube

Estate And Gift Taxes What Are Portability Elections

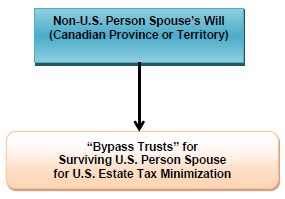

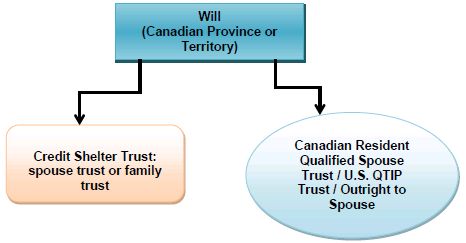

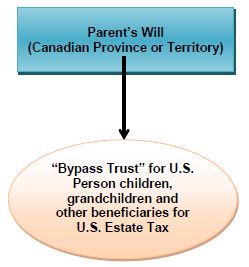

Will And Estate Planning Considerations For Canadians With U S Connections Tax Authorities Canada

Special Rule Of Regulations Section 20 2010 2 A 7 Ii Trust Me I M A Lawyer

Tips For Filing Taxes When Married Rings Married Married Couple

Will And Estate Planning Considerations For Canadians With U S Connections Tax Authorities Canada

Income Tax Refunds Constitute Property Wealth Management

Take The Quiz Are You Filing Your Taxes Correctly Gobankingrates

Will And Estate Planning Considerations For Canadians With U S Connections Tax Authorities Canada